Introduction

Property & Casualty (P&C) insurance companies face complex, labor-intensive workflows across underwriting, policy management, endorsements, and claims. Despite digitization efforts, much of this work remains manual, fragmented, and tied to legacy systems. With AI in insurance, Property & Casualty insurers can remove manual bottlenecks in policy, claims, and underwriting. This will not require underwriters to spend hours on data entry, claims adjusters to juggle paperwork and site inspections, and policy teams to navigate renewals across disconnected records. AI in insurance provides a practical way to streamline policy, underwriting, and claims processes without replacing legacy platforms. It accelerates decision-making, reduces manual errors, and modernizes operations while keeping existing systems intact.

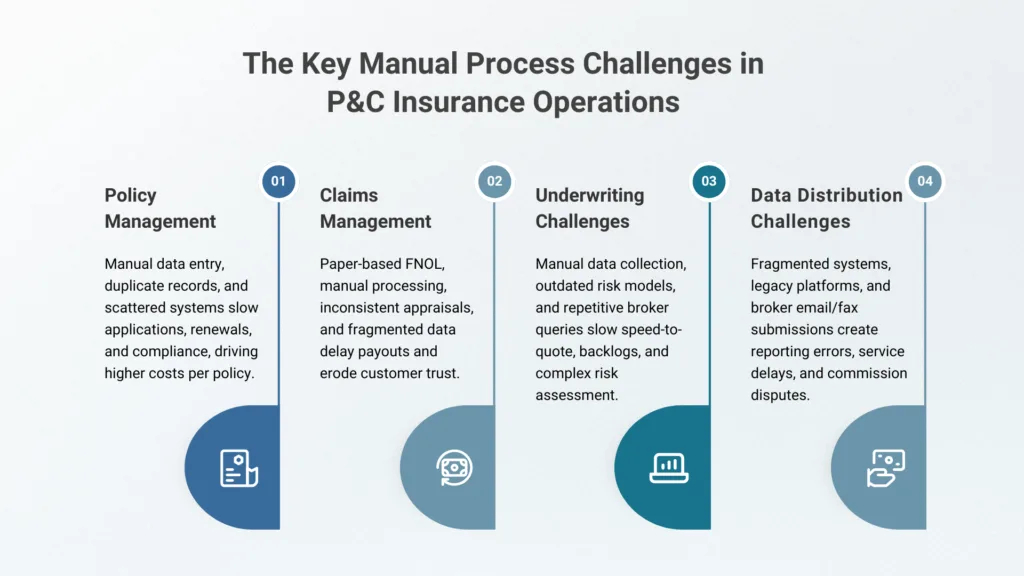

The Manual Process Bottlenecks in P&C Insurance

87% of policyholders believe that their claims experience impacts their decision to remain with an insurer. For most U.S. P&C insurers, the gap between strategic ambition and operational reality lies in the manual, fragmented workflows that dominate their daily business. Even with investments in digital portals and upgraded core platforms, underwriters still re-enter data by hand, adjusters still juggle stacks of documents, and policy administrators still chase down missing information across multiple systems. These are not small inefficiencies; they shape customer experience, compliance risk, and ultimately, profitability.

Policy Management

Policy management is where inefficiencies compound across the lifecycle of every contract. Despite investments in policy management software, much of the work still happens manually:

Application Intake & Validation: Policy management remains labor-intensive because applications often arrive via PDFs, broker emails, or faxes. Underwriters and policy administrators spend hours manually entering this data into core systems. Duplicate entries across policy admin, billing, CRM, and compliance systems create errors such as mistyped VINs, missing drivers, or incorrect addresses, slowing processing and frustrating brokers. Some carriers still rely on printed forms that must be scanned before digital entry, slowing the process further.

Renewals & Endorsements: Routine renewals and coverage changes require repetitive updates across multiple systems of policy admin, billing, rating engines, and CRM. Staff often switch between platforms, while approvals pass through several hands, turning a one-day change into a week-long process, increasing operational costs and delays.

Client Record Maintenance & Compliance: Policy records are scattered across systems with inconsistent update cycles, making audit trails difficult to trace. Manual updates risk incomplete timestamps and missing approvals, creating gaps during regulatory audits. Executives recognize that time spent feeding systems increases servicing costs per policy while adding little value.

Every extra keystroke adds cost without value. Executives know their teams are spending more time feeding systems than serving customers or brokers. Servicing costs per policy rise year over year because automation hasn’t closed these gaps.

Claims Management

Claims represent the insurer’s brand promise, but manual bottlenecks erode both speed and trust.

First Notice of Loss (FNOL)

Most claims still start via phone, fax, or static web forms. Staff must manually enter the same information into multiple systems, while customers often repeat details due to disconnected platforms. Some carriers still rely on paper intake that must be scanned before processing, adding days to the timeline.

Claim Verification & Processing

Adjusters manually schedule site visits, capture photos, write reports, and upload documents, each step prone to delay. Differences in individual judgment create inconsistent valuations, while back-office teams spend hours reconciling adjuster notes, repair estimates, and appraisal reports before issuing payouts.

Appraisals & Dispute Resolution

Appraisals involve multiple hand-offs among internal teams, third-party vendors, and legal counsel. Staff manually compare valuations, track email correspondence, and re-enter numbers into claims systems. These delays extend cycles, frustrate customers, and increase litigation costs.

Fraud Detection

Carriers rely on static rules, triggering high false positives. Adjusters spend hours investigating low-risk claims, while subtle fraud often goes undetected. Disconnected systems prevent holistic review, forcing manual reconciliation and slowing decision-making.

Data Fragmentation Across Functions

Claims, billing, and subrogation teams manage separate databases, requiring staff to manually reconcile data for even straightforward claims. Lack of synchronization creates reporting errors, reserve miscalculations, and reinsurance delays, eroding both operational efficiency and customer trust.

Customers expect digital-first claims handling, instant FNOL, faster payouts, and clear updates. Instead, delays stretch into weeks, staff frustration builds, and carriers face rising costs per claim.

Underwriting

Underwriting should deliver speed and precision, yet it is slowed by clerical work and outdated risk models.

Data Gathering & File Assembly

Underwriters manually gather property details, claims histories, credit scores, inspection reports, and broker notes from spreadsheets, portals, and legacy systems. Complex cases often involve multiple underwriters reassembling the same data, consuming hours. Routine submissions still require full manual review using outdated rating tables and actuarial models. Backlogs build, brokers wait days or weeks, and premium decisions lag real-time risk exposure.

Risk Assessment

Even routine submissions require full manual review, guided by static rating tables and outdated actuarial models. Underwriters make judgment calls without real-time data, leading to backlogs and delayed decisions that frustrate brokers and reduce competitive responsiveness.

Premium Setting

Premiums are calculated from historical data, rarely incorporating real-time signals like weather, geospatial risk, or market trends. Without AI in insurance underwriting or automated underwriting systems, pricing often lags actual risk. Underwriters spend hours updating systems and responding to repetitive broker questions via email threads. Manual premium adjustments and inconsistent documentation create compliance exposure, limiting focus on complex risk assessment.

Operational Overhead & Communication

Underwriters spend significant time updating multiple systems and answering repetitive broker questions via long email threads. Manual premium adjustments and inconsistent documentation create compliance exposure, diverting focus from strategic risk assessment and value-added decision-making.

Instead of focusing on strategic or complex risks, underwriters feel trapped in clerical cycles, copying, pasting, and reconciling data. Executives know that without automated underwriting, speed-to-quote will remain a competitive liability.

Data and System Challenges

Beyond the obvious bottlenecks in policy, claims, and underwriting, insurers battle a quieter but equally costly problem: fragmented systems and legacy platforms. Policy, claims, billing, and distribution data often fail to reconcile. Finance teams struggle to produce reliable reports, and executives lack confidence in dashboards meant to guide strategic decisions.

Even carriers that modernized core systems find themselves in modern legacy traps, with customized platforms that still require manual workarounds. A small product change can ripple through the system and demand weeks of IT intervention. Audit and compliance work suffers too: when evidence is spread across multiple systems, teams must scramble for weeks to prepare for a regulatory review.

Distribution and Broker Service

The friction extends into distribution. Brokers frequently send submissions and endorsements via email or fax, leaving carrier staff to re-key the information into core systems. Brokers cannot easily check claim or endorsement status, so they call service centers repeatedly for updates. Meanwhile, finance teams manually reconcile commission disputes because carrier and MGA systems rarely align.

How AI Solves These Pain Points

The manual workflows inside U.S. P&C insurers’ policy management, claims, and underwriting aren’t simply inconvenient. They create measurable financial drag: slower cycle times, rising loss adjustment expenses, compliance headaches, and frustrated staff. AI doesn’t erase the complexity of insurance, but it removes the bottlenecks that shouldn’t need human effort in the first place. From faster claims settlement to proactive compliance monitoring, AI in insurance delivers measurable outcomes that directly improve profitability.

AI in Policy Management: From Re-Keying to Intelligent Automation

Most insurers still rely on staff to re-key broker PDFs, emails, and handwritten forms into policy administration systems. Endorsements are handled through manual approvals and paper trails, while renewals slip through when reminders aren’t automated. These tasks increase errors, delay renewals, and frustrate both brokers and policyholders.

AI-driven policy management software addresses this directly:

- Intelligent Document Understanding uses OCR and natural language processing to automatically extract data from applications, endorsements, and broker emails. This eliminates duplication, reduces human error, and ensures that policy information enters the system correctly the first time.

- Automated Policy Management handles routine endorsements, such as coverage adjustments or beneficiary changes, through event-driven workflows. Policy administrators no longer manually verify eligibility for standard requests.

- Policy Monitoring & Audit Trails enforce compliance automatically. Each record is timestamped and tracked, so regulators and auditors can access a complete, consistent history without pulling multiple spreadsheets or chasing approvals.

- AI-driven Customer Communication systems automatically deliver personalized renewal reminders and coverage updates, which reduces service calls and manual outreach by policy teams, and improves retention.

Policies move from creation to renewal with minimal manual touchpoints, operational errors drop, and staff can focus on higher-value exceptions rather than routine processing. A leaner policy management process that lowers servicing costs while ensuring that insurance policy management services remain compliant and auditable.

AI in Claims Management: From Paper Trails to Automated Claims Processing

Claims departments face the most visible pain: manual FNOL intake, paperwork overload, physical inspections, inconsistent valuations, and fraud detection gaps. Teams spend hours manually coordinating adjusters, verifying documentation, and chasing approvals, often leading to delayed payments and dissatisfied policyholders. The result is long cycle times and rising loss adjustment expenses. Through automated claims processing, insurers improve fraud detection, accelerate FNOL, and deliver faster payouts to policyholders.

AI enables automated claims processing across the entire workflow:

- Automated Claims Intake: AI chatbots and voice assistants collect FNOL data, auto-fill policy information, and score claims for urgency. Adjusters only focus on cases flagged as high complexity.

- Claims Automation in Insurance: Machine learning triage prioritizes claims based on risk, historical patterns, and coverage validation. Straight-through settlement is possible for low-risk claims.

- Photo & Drone-Based Damage Assessment: Computer vision models evaluate property damage remotely, reducing manual inspections, improving consistency, and enabling faster payouts.

- Fraud Detection & Anomaly Scoring: ML algorithms identify unusual patterns across claims, external data, and historical trends, minimizing false positives and lowering the risk of fraudulent payouts.

- Integrated Claim Management Automation Solutions: By connecting claims, billing, and fraud teams through a unified AI platform, the data silos that previously caused delays are removed, and cycle times shrink from weeks to days.

With faster FNOL processing, quicker appraisal and payout, reduced administrative work for adjusters, automated claims processing is a competitive differentiator in customer satisfaction. By deploying AI automation in insurance claims, carriers can reduce cycle times from weeks to days, lower LAE, and deliver payouts when policyholders need them most.

AI in Underwriting: From Manual Judgement to Data-Driven Decisioning

Underwriting in P&C insurance remains resource-intensive, particularly for complex commercial risks. Staff manually collect risk data from multiple sources like claims history, geospatial records, credit reports, public filings, and spend hours assembling dossiers and calculating premiums. This is where AI in insurance underwriting provides the clearest ROI.

- AI in Insurance Underwriting: AI models consolidate fragmented data into a single risk profile, enabling faster, more accurate assessment of routine and complex risks.

- Automated Underwriting: Standard policies can be processed end-to-end with minimal human intervention. AI calculates recommended premiums based on historical claims, location risk, and predictive exposure models.

- Underwriter Assistance Tools: Dashboards integrate third-party data, policy history, and fraud alerts to reduce manual research. Underwriters make decisions only on exceptions, improving throughput and accuracy.

- Generative AI in Insurance: Automatically drafts policy documents, analyses loss runs, and suggests coverage options. This eliminates repetitive drafting while maintaining compliance and precision.

- Dynamic Risk Scoring & Premium Recommendations: AI continuously updates risk models as new claims or exposures occur, allowing underwriters to respond in near real-time rather than relying on static spreadsheets.

With AI in insurance underwriting, the administrative burden decreases, underwriting throughput rises, and manual underwriting errors are minimized. Underwriters are freed to focus on strategic evaluation of complex portfolios rather than clerical tasks.

The Net Effect

Across policy, claims, and underwriting, the value of AI in the insurance industry comes from:

- Removing repetitive, low-value manual tasks.

- Providing consistent, audit-ready processes for compliance.

- Accelerating turnaround times to improve both efficiency and customer satisfaction.

- Enabling underwriters and adjusters to spend time where judgment is required, not on where data entry matters.

McKinsey estimates 30–40% of underwriting time is wasted on administration, and Forrester finds claims staff lose 12 hours per week chasing data. Intelligent automation in insurance reclaims that time and converts it into measurable business outcomes: lower costs, faster cycle times, and more resilient operations.

The Impact of AI in P&C Insurance

According to McKinsey, 60% of insurer performance is now driven by how companies operate (agility, adaptability, data confidence), not what they insure. Deploying intelligent automation in insurance across policy management, claims, and underwriting is not just a technology upgrade. It directly reshapes operational performance, risk management, and customer satisfaction. True automation in insurance requires more than digitized portals; it needs AI-driven workflows that connect underwriting, policy, and claims. The benefits are measurable, tangible, and felt across the organization.

Faster Cycle Times

Manual workflows have long slowed P&C operations. Policies take days to process due to repeated data entry, fragmented approvals, and compliance checks. Claims often linger for weeks while adjusters coordinate inspections, validate documents, and detect fraud.

AI-driven automation accelerates both policy issuance and claims resolution. Intelligent document processing, automated endorsements, and pre-populated templates reduce repetitive manual work, while AI triage, automated damage assessment, and straight-through settlement expedite claims handling. Insurers can respond faster to customers, brokers, and regulatory requests.

Lower Operating Costs

Re-keying data, coordinating inspections, and manually verifying documents consume staff time and drive rework, resulting in a significant portion of operational expenses.

AI lowers these costs by automating repetitive policy and claims tasks, minimizing approvals, and reducing errors or inconsistent valuations. The result is a lower cost per policy and per claim, allowing insurers to redirect resources to strategic decision-making and growth initiatives.

Improved Accuracy & Compliance

Fragmented data and manual processes increase the risk of errors and regulatory exposure. AI provides standardized claims valuations, fraud detection models, and audit-ready data trails.

By integrating AI with policy management software, insurers gain error-free recordkeeping and audit-ready compliance. Integrated platforms consolidate previously siloed systems, giving a single source of truth. This reduces mistakes, simplifies regulatory reporting, and ensures executives, auditors, and regulators can trust the operational data.

Better Customer Experience

Policyholders now expect speed, transparency, and personalization. Traditional processes with long FNOL handling, slow renewals, and inconsistent communication erode trust.

AI enables faster payouts through automated claims triage and remote assessments, personalized renewal communications, and real-time updates for brokers and customers. This improves satisfaction, retention, and loyalty, while giving carriers a competitive edge.

Strategic Agility

Manual reconciliation and disconnected systems have historically limited an insurer’s ability to make quick, informed decisions. AI provides real-time insights across policies, claims, and underwriting, supporting dynamic pricing, scenario modeling, and faster product launches.

Clean, governed data allows leadership to move from reactive operations to proactive decision-making, responding quickly to market changes and emerging risks.

McKinsey found that up to 40% of carrier expenses sit in 20–30 core processes like underwriting and claims. Automating even part of these creates measurable cost savings and a competitive advantage.

Frequently Asked Questions:

How can AI help reduce the time it takes to process policies and endorsements?

AI can automatically extract and validate application data from emails, PDFs, or broker portals, reducing manual re-entry errors. Intelligent workflows can route endorsements for approval and update records across systems in real time, cutting processing from days to hours.

What impact does AI-driven underwriting have on risk assessment and premium accuracy?

AI models can aggregate historical claims, geospatial data, and market trends to generate dynamic risk scores, enabling faster, more consistent pricing decisions. This reduces backlogs and ensures premiums better reflect real-time risk exposure.

Can claims processing be fully automated without compromising fraud detection or compliance?

Yes, AI can pre-screen claims, prioritize high-risk cases, and flag anomalies for human review, maintaining compliance and improving accuracy. Routine claims can be auto-settled, freeing adjusters to focus on complex cases.

How do AI and automation integrate with legacy policy and claims systems?

Modern AI solutions can be layered on top of existing systems via APIs or intelligent document processing, so carriers don’t need to replace core platforms. This allows digital workflows, real-time data access, and audit-ready records without major disruption.

What are the measurable benefits of automating policy, underwriting, and claims operations?

Automation reduces administrative overhead, shortens cycle times, and minimizes errors, lowering costs per policy or claim. Executives also gain faster access to performance insights, improving decision-making, customer satisfaction, and competitive positioning.

AI Automation Solutions in Policy Management, Underwriting & Claims for P&C Insurers

Bluetick Consultants Inc. is a leading AI development company in the U.S., specializing in delivering customized AI solutions for the insurance industry. Our team combines deep technical expertise with AI in insurance, AI underwriting, and automated claims processing with a thorough understanding of operational challenges in Property & Casualty (P&C) insurance companies.

We helped Property & Casualty (P&C) insurers modernize legacy systems, unify fragmented data, and automate labor-intensive workflows, including:

- Policy Management Automation: Intelligent document processing, automated endorsements, and centralized digital record-keeping that reduce manual effort and ensure audit-ready compliance.

- Claims Automation: AI-powered triage, fraud detection, and automated appraisal systems that speed up payouts while reducing operational risk.

- AI Underwriting: Advanced risk scoring, model-assisted decisioning, and intelligent document understanding that accelerate approvals and support consistent pricing strategies.

With Bluetick Consultants Inc., insurers gain a practical, research-driven roadmap to AI adoption, addressing real-world pain points in underwriting, claims, and policy management. We do not just implement technology; we embed AI into core operations, enabling measurable efficiency gains, reduced costs, and improved customer experience.

Take the Next Step Toward Smarter P&C Operations

Bluetick Consultants Inc. works closely with insurers to design and deploy AI solutions that align with your operational realities. From streamlining policy intake to automating complex claims workflows and enhancing underwriting accuracy, we turn insights into actionable outcomes.